Bitcoin: winning, but not how we thought

Reflections on Baltic Honeybadger 2025 in Riga, Latvia

Bitcoin is near $120k, but somehow it doesn’t feel the way it ‘should’. I recently got back from Riga attending a few events, Bitcoin++ Privacy edition, Thunderstorm, and Baltic Honeybadger and thought I’d share a few learnings. In earlier years at BH (say in 2019), there was definitely a very strong cypherpunk and libertarian ethos running through the event.

Somehow in our minds, we thought Bitcoin adoption would be driven by more people using their own hardware wallets and phones in a more privacy and sovereignty preserving way, and the debates were between the NoKYC vs “KYC is OK for onboarding” and on exchanges. We generally envisioned that each hype cycle would come and each time there would be a new mass of people signing up on bitcoin (and shitcoin) exchanges, and that during times of high market load the exchanges would go down. Custodians were not to be trusted as the stories of Mt Gox or QuadrigaCX were too close in memory.

But here and now in August 2025, with Bitcoin’s price at 12x of what it was around the time of Baltic Honeybadger 2019 - it’s hard to argue that Bitcoin hasn’t been successful. Just not how we thought it would be. Nowadays, the tension is more about whether you use self custody BTC at all, versus so-called “Paper Bitcoin Summer”. The rise of Bitcoin ETFs and Bitcoin Treasury Companies has caused some resentment or debate in the hardcore bitcoiner community. Though there are certainly some supporters, or perhaps some who begrudgingly accept that it can’t be stopped.

Overall, the vibe at the conference was great with chances to catch up with lots of people and learn about new bitcoin projects. Well done to Max, Anna and the Debifi & Hodl Hodl team putting it together and thanks again for inviting me as speaker/moderator.

Stream links here for anyone interested:

Baltic Honeybadger Day 1 livestream YT

Baltic Honeybadger Day 2 livestream YT

Now firstly, I made a stop by at Bitcoin++ Privacy edition, hosted at the National Library of Latvia.

I learned about a few interesting projects going on (such as eltor, a LN incentivised version of the Tor network), but couldn’t spend long as I had to make my way over to the Thunderstorm event (which I will affectionately call a ‘suitcoin’ event).

On this day it was mostly discussions around Bitcoin Treasury Companies, Bitcoin Banking, Bitcoin Custody and some discussion about Latvia for Bitcoin companies and entrepreneurs.

EU regulation wise, MiCA was certainly a big topic of the day, with the idea being that if you can get a MiCA licence in any one EU country that you can ‘passport it’ to other EU countries to enable service provision to those other countries easily.

Even here, there were some debates about the overly bureaucratic and onerous regulatory direction the EU is going down. For example, some of the new EU rules are hindering true bitcoin innovation that enables better self custody, as rules tend to be written around existing (and custodial solutions). Sometimes government bureaucrats, politicians and those working in legal consultancy don’t seem to grasp that they are in competition with other jurisdictions around the world - which can sometimes cause them to ‘rest on their laurels’ and/or fallback to the “we have men with guns” type arguments.

Custody centralisation into Coinbase was also a noted concern, with efforts required to decentralize custody into self custody, or at the very least, into many professional grade institutional custodians.

The evolution of the bitcoin lending market was also a big topic, with a big growth on both the lender side and the borrower side. Some discussions about interest rates coming down, and why people borrow, as well as what would be required for longer term loans. Also discussions about trade offs of the fully custodial TradFi style model, or the more on-chain DeFi style lending model. Perhaps there is room for both to grow, and even for these two worlds to merge.

On to the main 2 days of Baltic Honeybadger! Giacomo opened things up with his comedic delivery as usual, doing a parody of Saylor’s conference talks, with some bitcoin memes sprinkled in and playful jabs at bitcoin treasury companies. Good fun, and you can check it out on the livestream links above.

Paper Bitcoin Summer

Here’s the Paper Bitcoin Summer panel I moderated with Adam Back (Blockstream and BSTR), Preston Pysh (TIP) and Sander Andersen (H100).

We spoke about the rationale for MNAV premiums, also comparing with fiat market P/E ratios being very high.

Preston pointed out how many people do NOT understand how these companies are creating bitcoin yield. You have to understand 1) bitcoin, 2) security analysis and 3) how broken the fixed income market is.

Adam believes this bitcoin treasury company model is scalable and that there is a huge arbitrage between the bitcoin price today and the eventual price (who knows, $10M+ per bitcoin?). Generally he agreed that there will be a ‘hometown hero’ dynamic and some countries will have a specific regulatory or tax reasons also.

Sander pointed out that smaller growth companies can justify a higher MNAV, and also that a lot of the capital raising is being done with professional investors and funds, not necessarily just from retail investors.

Ark - a new production L2 for Bitcoin?

Here’s an Ark fireside chat I did with Steven Roose from 2nd and Kukks from Arklabs (creators of Arkade) explaining their visions of how Ark can be used to drive Bitcoin use. I believe the vision of the 2nd BTC team is more payments focused, while the Arklabs/Arkade vision is a bit more expansive and focused on this notion of an off chain execution layer to allow other use cases and payments too.

Also really interesting was the fact that Arkade was being used in the background for all the food/drink merchants at this conference to seamlessly take bitcoin payments. See this video by Mir. And it looks like it was also done using ecash here by Eric Sirion. And here’s a short clip explainer from Kukks of Ark labs explaining it.

So in short: the payments were lightning enabled, but in the background it’s being flipped from lightning into Ark VTXOs (in partnership with boltz.exchange). The merchant then has an Arkade wallet with their balance of VTXOs (Virtual Transaction Outputs), and these VTXOs can be batched for an exit back to main chain ‘real’ Bitcoin UTXOs (Unspent Transaction Outputs). But the point being, the complexity is all in the background, and the user just gets a simple click ‘send’ or click ‘receive’ experience.

So in a way this is showing that ‘real’ L2s other than Lightning are becoming real. Arkade will be hitting main net launch shortly from what I see Kukks saying.

Power trend/law and where things end up

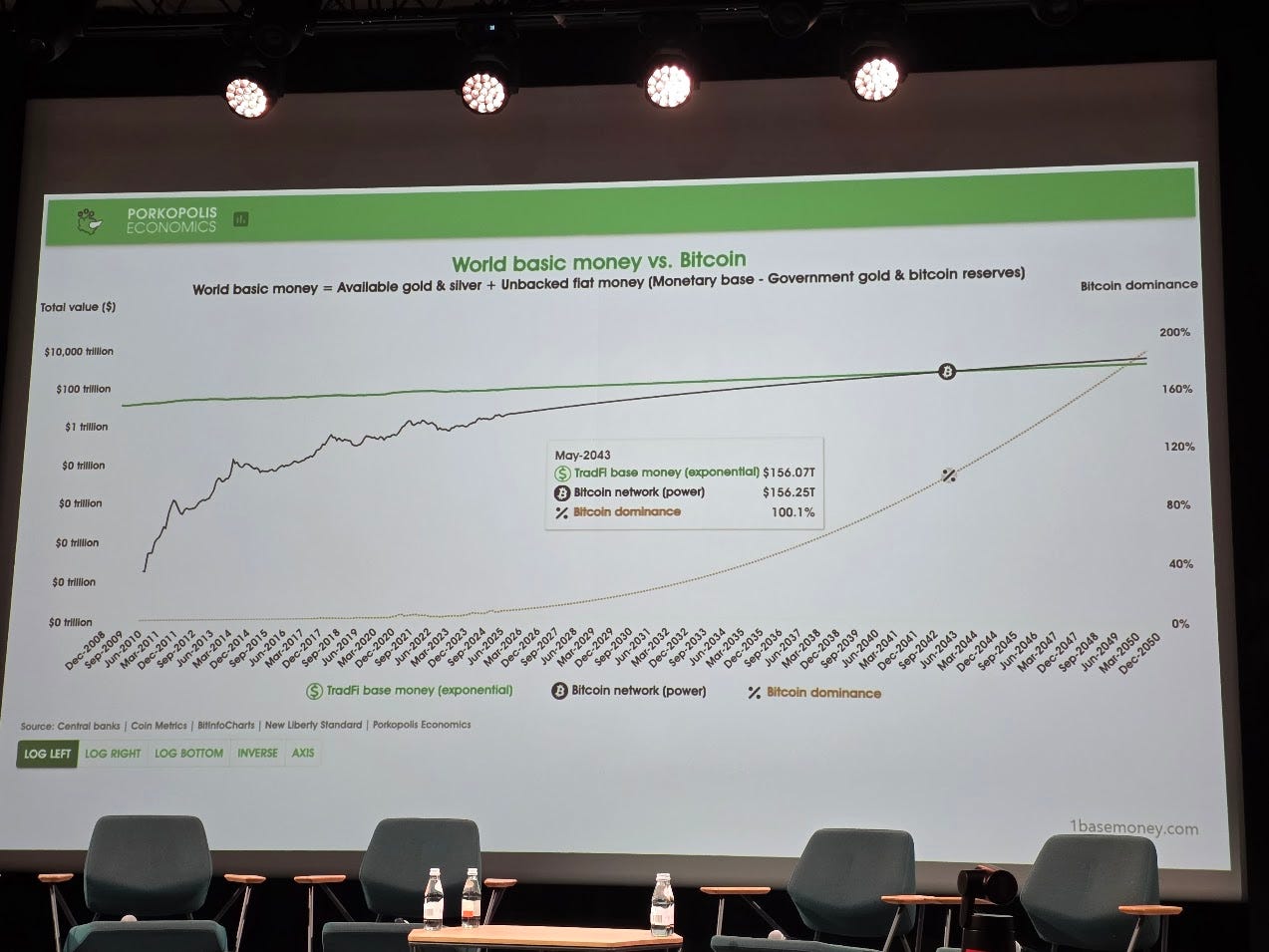

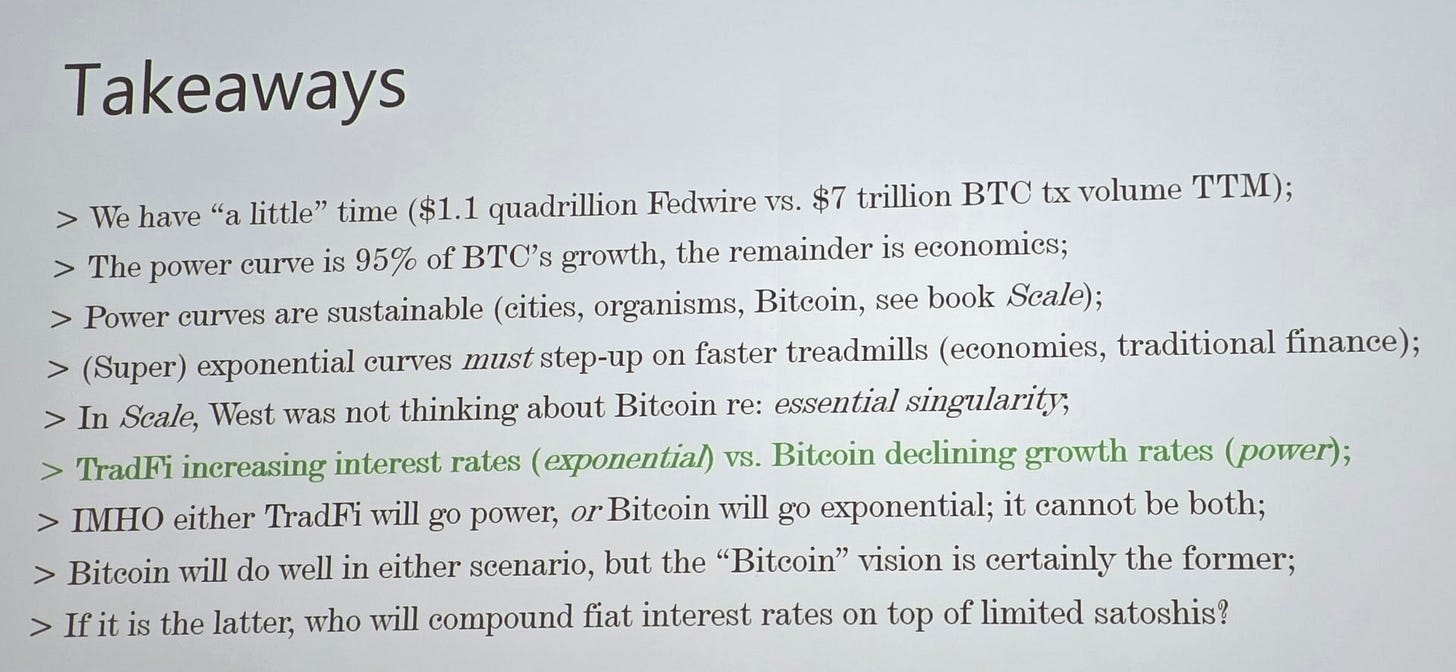

As many of you know, I’m a fan of Bitcoin power law analysis. Matthew Mezinskis did a great talk (though he doesn’t like the term ‘Power law’ and prefers power trend). I liked the comparison of growth rates of the stock market, central bank balance sheets being exponential, while Bitcoin grows in power. Bitcoin being MOSTLY an adoption story, whereas the TradFi fiat system simply needs exponential growth to even stay alive…

See Matthew’s chart here showing the ‘crossover point’ where bitcoin network is projected to meet the TradFi base money number - around 2043 or so. Things will get very interesting in that 2040s decade!

If you see Matthew’s final takeaways slide, I find it fascinating to think about which way this is going to go.

Is TradFi going to turn into a power law or will Bitcoin become an exponential? I believe we will eventually get onto a bitcoin standard with bitcoin denomination, which also implies that the TradFi system will have to change into a power based growth system. My reasoning being: the opposite implies that there would still be a lot of fiat cash or fiat bond bag holders, who are simply happy to willingly be debased. Why would they do that? Or perhaps they will be coerced? Who knows. It’s exciting to think about and envision what happens as Bitcoin grows.

Privacy, decentralization and Bitchat

While we had a lot of bitcoiners all together, we did play around with Bitchat, a bluetooth mesh chat app. Jack Dorsey made the first version on iPhone and Calle followed up quickly with an android version. It was used over at the cypherpunk stage to take anon audience questions. Of course it’s early days, and there are open questions about whether such a system really will work at scale and how it would handle DOS/Spam etc. But basically its an app you join (android here), and then you can see who else is physically nearby in the chat in the top right (18 people in this example).

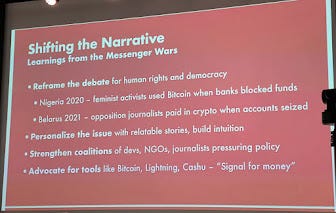

Now Calle also gave a sobering talk at the conference about the realities of privacy and freedom in our modern digital age. So while Bitcoin NGU, the privacy and freedom aspects are certainly being challenged.

Calle’s message was to personalize it, use stories and rally the people (devs, journalists, freedom minded people) to help refocus on human rights.

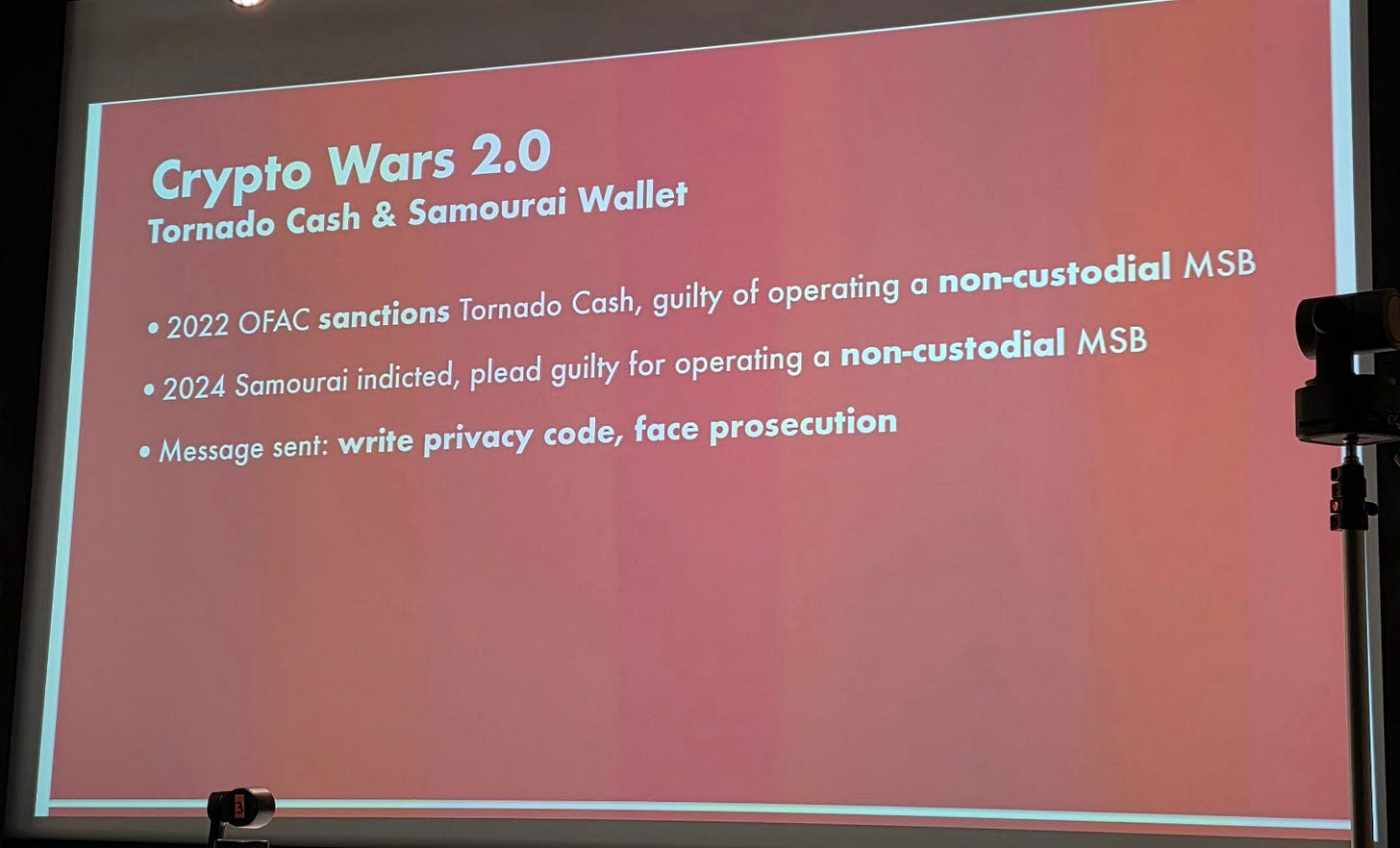

And of course there has been a real cost, with the Tornado Cash and Samourai Wallet devs getting into trouble. #FreeSamourai and all, but I believe part of this is about pushing back on this narrative that ‘privacy is only for criminals’, and pushing back against unjust BSA, AML/KYC, Sanctions laws and FATF.

So yes, while NGU is going on, there are still struggles on the privacy and freedom front. I will be chatting with Calle on my podcast soon so make sure to be subscribed for that.

Closing thoughts

So summing up, Bitcoin is winning in a way that most bitcoiners did not foresee. Instead of lots of new people going to buy bitcoin either p2p or from typical KYC exchanges, we have a lot of people buying Bitcoin ETFs and Bitcoin Treasury Co’s or Treasury Co equity or debt. So it’s almost like an indirect form of buying bitcoin because many investors can’t or won’t buy bitcoin directly - but they would buy debt, preferred share instruments or equity in a treasury company that WILL then buy bitcoin.

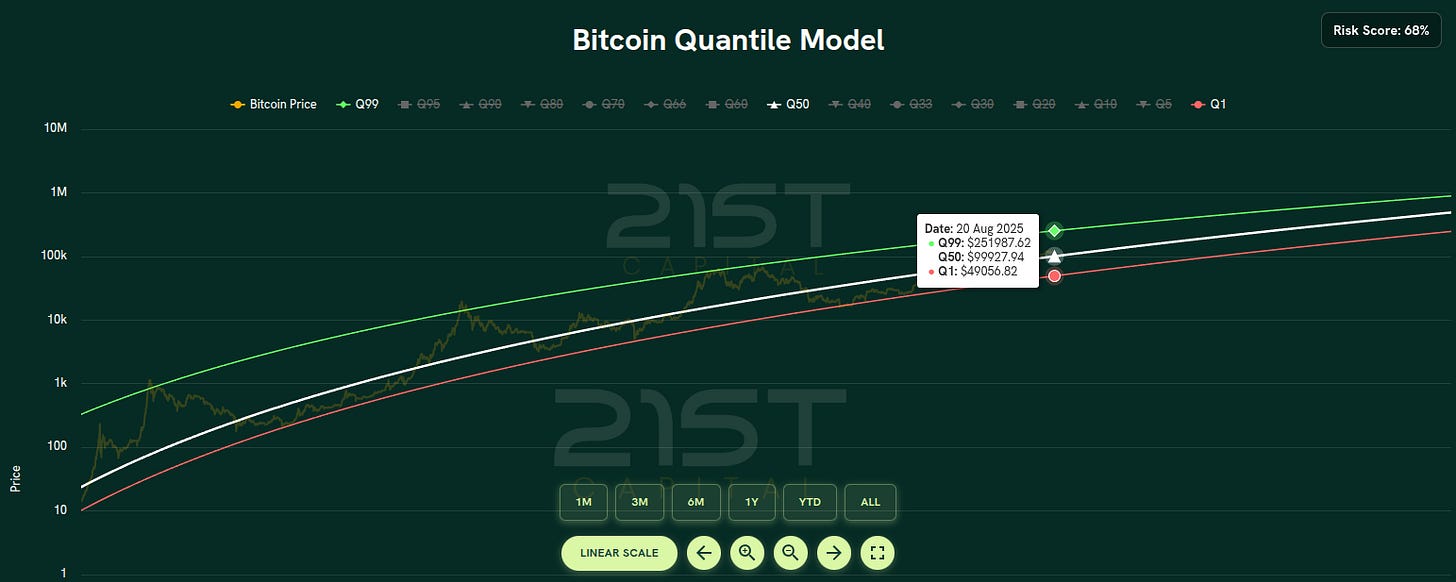

Zooming out a little, I still believe we’re just a bit above the power law or trend line. This chart is from 21st Capital’s BI dashboard:

So we’re really not in the ‘euphoria’ phase of the bull market, and there is some debate about whether 4 year cycles hold, or whether it’s now more just independent of the halving. Even with the price near all time highs, it’s not like we’re seeing massive all time highs in other typical metrics like conference attendance, meet up attendance, podcast downloads, on chain volumes and fees, or even google search volume. Perhaps the big question is, do we keep on ‘stair stepping up’ with consolidation periods, or do we later hit the typical ‘euphoric bull run’ in Q4 this year? If I’m guessing, perhaps it extends out to next year, but I will be watching power law and quantile bands to get a background sense of where we are.

Nobody knows, but stay tuned to my newsletter and podcast to be up to date. If you like this, please do share and subscribe.

Testing something