Why should everyone focus on Bitcoin?

It's the only alternative to the dollar

So I recently had the pleasure of attending BitcoinSeoul2024 in Korea. I took part in a fireside chat with my friend, Saifedean Ammous, where we spoke about Why World Leaders Should Focus on Bitcoin.

Some highlights from the discussion were that truly, there is no alternative to saving with Bitcoin. Anything else you hold can be inflated away faster than the returns or yield you get on the thing, whether it is bonds, physical property, stocks or gold.

So at the end of the day, whether you are an individual, a company, a trust, or even a government, it benefits you to HODL Bitcoin.

I also took part in a bunch of other sessions, such as moderating some Bitcoin development discussion, an L2 panel discussion, and also a regulatory overview with Grant McCarty from BPI.

Constant maintenance and development of Bitcoin is necessary, because as Satoshi originally coded it, it wouldn't even run on modern operating systems and computers because it was built for older operating systems.

The responsibility for bitcoin maintenance is with everyone, given that there is no one company or person in charge. For some that is donating money, for others it is reviewing code and directly developing themselves.

Keep an eye out for an upcoming episode with interviews I took while at BitcoinSeoul!

News hits:

The impact of the state of Wisconsin investing in Bitcoin ETFs is rippling out further. Here, David Krause is explaining the significance of this, and how it was previously thought that it would be several years before this kind of institutional investment in Bitcoin.

US Senator, Cynthia Lummis says Bitcoin is going to be an “important part of our economy going forward”.

With Semler Scientific announcing their Bitcoin treasury strategy and Metaplanet authorising purchase of additional ¥250 million worth of Bitcoin on the same day, the race for corporate Bitcoin accumulation is heating up.

LND 0.18 just released with some features being smarter sweeps to improve efficiency, inbound fees for discounts to optimize routing, SQL for invoices to boost node performance and more.

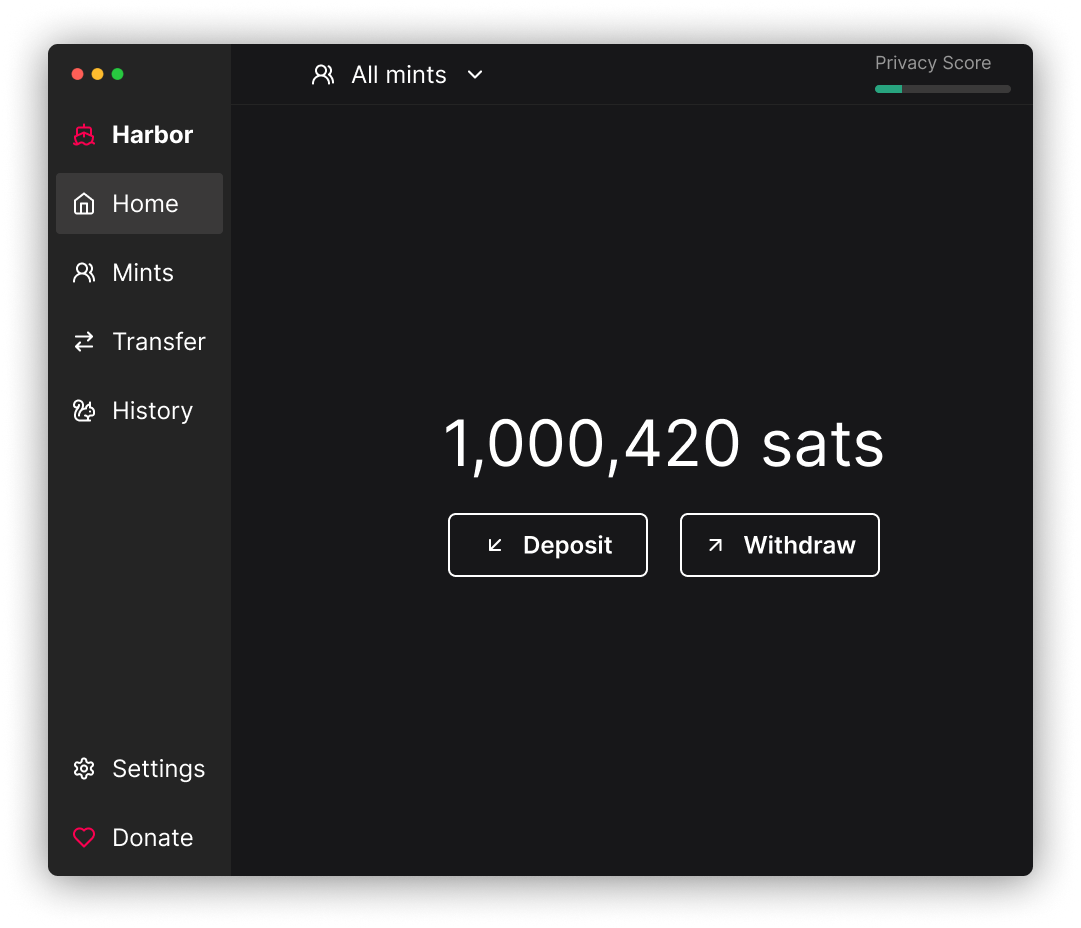

The team behind Mutiny wallet announced their latest release - a new desktop app, Harbor. Harbor is an ecash desktop wallet for better privacy. Harbor differentiates from Fedimint-based Mutiny Wallet or other ecash-based wallets with three main distinctions: Privacy, multi-mint, and automation.

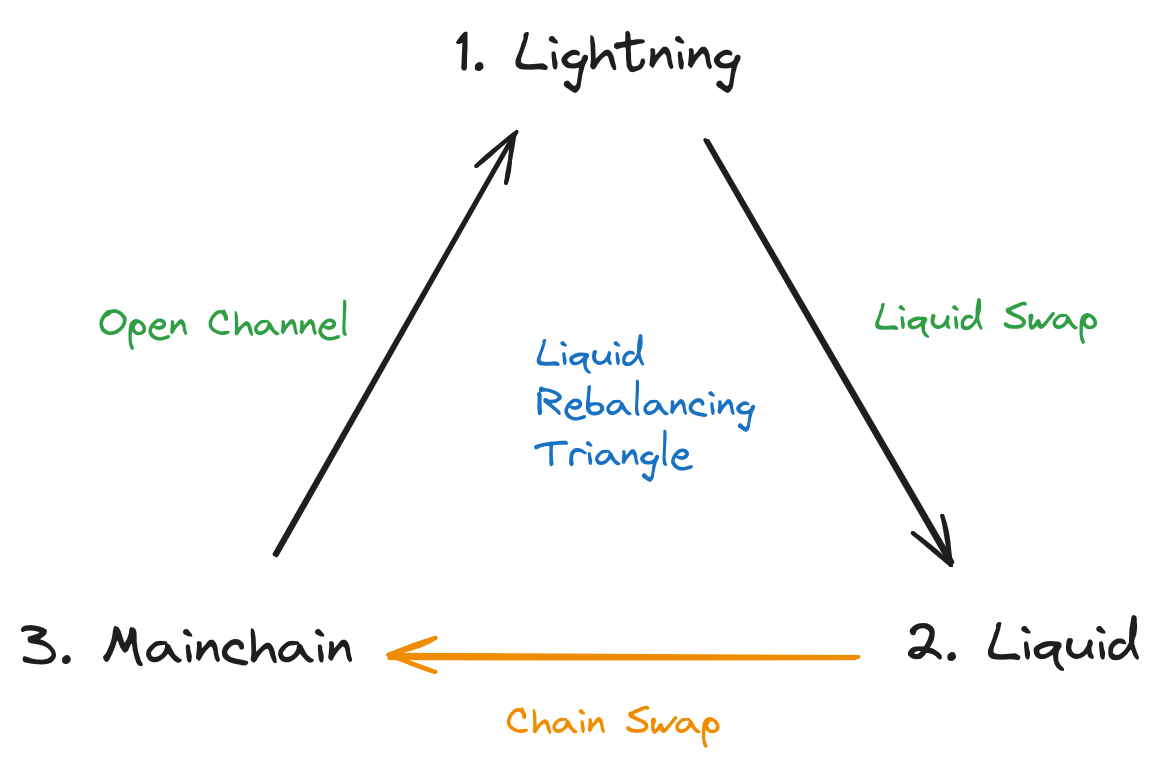

Boltz released chain swaps which enables users to swap between Liquid and the mainchain with both sides being regular on-chain transactions. Read more about how it works here.

Setor Blagogee shares a draft specification for a protocol to help lightweight clients receive Silent Payments (SP).

Pierre Rochard & Anthony Towns discuss whether opcodes with overlapping features should be added in a soft fork. Read more about it here.

Tl;dr Podcast summaries:

Silent Payments: A Bitcoin username? With Josibake and Ruben Somsen | SLP579

Silent Payments (BIP 352) proposes publicly shareable codes which enable users to accept donations or regular payments without re-using addresses. Think of this as both a privacy and UX improvement.

Silent payments is used by bitcoin wallets, and it is not a bitcoin consensus change.

However, one challenge for wallet developers is that silent payments requires additional computation by recipients to identify payments. This process is easier for full nodes but may pose some challenges for light clients.

Note though, that this would be a great improvement in the ecosystem if we could get more wallets to at least start with adding SP send support, that would be a great first step.

Bitcoin and MEV with Walter Smith SLP580

Walter defines MEV as a miner being able to insert, reorder or tinker with the transactions before they are entered into the blocks. It is generally referred to as the extra value that a miner gets from expressing some optionality over a block.

RBF, front-running an ordinal mint, miner cartelisation are some of the forms of MEV which Walter touches upon in his article.

We are currently in the 3.125 BTC/10 min era, and what most people anticipate is that over time the block subsidy will reduce as the transaction component rises. If people choose to try and do ‘other things’ on bitcoin apart from using it as a purely monetary technology, this may create more transaction fees and more MEV ‘bounty’ for mining pools.

Walter’s view seems to be that MEV should be ‘embraced’ by the community with more expressive OP codes and expansions of what Bitcoin can do. Whereas I point out that this is not uncontroversially accepted by the community and that there are many Bitcoiners who aren’t necessarily on board with new OP codes. While some things are potentially enabled by BitVM, and there are new start ups and projects working on this, it’s not clear how big they’ll get. In the end though, Walter sees all this as Bitcoin ‘suffering from success’.

Upcoming conferences:

BTC Prague June 13-15th 2024 in Prague, Czech Republic - code LIVERA

Nomad Capitalist Sept 25-28, Kuala Lumpur Malaysia (tickets sold out but wait list possible)

Pacific Bitcoin October 18-19 2024, Los Angeles, California - code LIVERA gets you 21% off